In the face of the extreme uncertainty about economic prospects as the pandemic and the shutdown continue, policymakers need as much information as possible. But exactly when they need it, information is in short supply.

One reason is simply that the people who gather and collate economic statistics have had to adjust to working from home just like the rest of us. For the statistics agencies, this has meant setting up appropriate online access for the staff and getting used to online meetings.

For collection of the raw data, such as prices of specific items in specific types of store for the consumer price index, shop closures pose a more fundamental challenge. Great care is taken to make sure the index covers people’s spending patterns, with the ‘basket’ of weights on different items updated annually. Perhaps with shops closed, online prices could be used instead. But what to do about items like flour that are not available, or hand sanitiser, which has been hard to find, rising in price, and is not in the current basket of goods. A couple of months of volatility in the CPI would not much matter, but the longer prices and spending patterns are disrupted the harder it will be to understand the pressures on people’s spending power.

Similarly, there are challenges for other standard economic statistics such as Gross Domestic Product. The economy is in a deep recession of unknown duration; output and spending have collapsed. However, it will be challenging to capture this in the statistics. Returning the Office for National Statistics (ONS) surveys will not be the highest priority among struggling firms. It will be hard to know which have gone out of business altogether. There are some definitional questions too, such as how to account for the income of furloughed workers (probably as a government subsidy to firms).

The official statistics are the most comprehensive and carefully constructed economic indicators available, but there is a need now for faster information. ONS has started two new surveys, one looking each week at individuals’ behaviour and attitudes and one every two weeks seeking to understand business impacts. The ONS Data Science Campus already had a programme looking at Faster Indicators such as VAT returns, and shipping and road traffic data. It is adding analysis of some private data sources such as credit card usage.

Private sector data has some limitations compared to official statistics, in particular in not necessarily covering a representative sample, but there is a lot of it and it can show patterns of behaviour changing very quickly. Vasco Carvalho and his colleagues have tracked the very large and steep drop in expenditure in Spain using transactions data from BBVA, the country’s 2nd largest bank. The potential usefulness to policymakers of such data is enormous. It can be tracked daily, and can reveal geographic patterns, switches between offline and online spending, and effects on particular sectors or supply chains. However, very few banks make such data available to official statisticians or researchers.

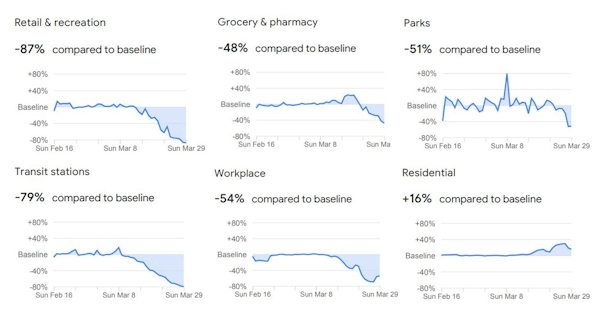

The digital giants, Google, Apple and Microsoft have all made some of their data available – for the duration of the crisis. Google has published Community Mobility Reports tracking activity in different places, and the ONS Data Science Campus extracted that data and made it available in a useful format. Users can also use Google Trends to search for various terms. Apple has made activity data from the use of Apple Maps available in a standard format. Microsoft Azure has created an open access database of covid-19 articles for use for research based on techniques like natural language processing, while Microsoft Bing has also collated open data resources.

Google Mobility Report - Cambridgeshire

Indeed, the crisis seems to have prompted Microsoft to throw its weight behind the importance of open data for public good, in a very welcome new campaign. Big technology and finance companies – as well as many public sector bodies – hold a vast amount of data than official statisticians and researchers could use to paint a more accurate picture of today’s economy and society, and inform policymakers better and faster.

The use of data stockpiles by the big digital companies to hinder competition for their market has been widely noted [for example in the Furman Review]. There is a wider point, though, about the potential public benefit left untapped because so much valuable information sits in private silos. The debate about the use of data for public good was under way before the pandemic. One good thing that could emerge from the current crisis would be greater access to the wealth of valuable information that could help policymakers stimulate and shape the eventual economic recovery.

About the author

Professor Diane Coyle is the Inaugural Bennett Professor of Public Policy at The Bennett Institute for Public Policy. Professor Coyle co-directs the Institute with Professor Kenny. She writes on the COVID crisis at the Bennett Institute Blog and is heading research in the fields of Public Policy Economics, Technology, Industrial Strategy and Global Inequality.