Elevated uncertainty, as triggered by COVID-19, leads to a decline in economic activity through both demand- and supply channels. In comparison to a pure negative demand shock, therefore, an uncertainty shock gives rise to a flatter Phillips curve relation between unemployment and inflation. We show how this result naturally arises in a search-and-matching model of the labor market. The analysis underscores the importance of stabilizing expectations about the future path of economy, to limit adverse effects in the present.

The macroeconomic effects of heightened uncertainty have concerned policymakers and economists for at least the past decade. Now, the spike in uncertainty triggered by the COVID-19 pandemic has exacerbated these concerns even further. Indeed, Baker et al. (2020) attribute more than half of the forecasted 11% contraction in US real GDP as of 2020 Q4 to COVID-induced uncertainty (also see Leduc and Liu (2020)).

Providing ground for such warnings, a rich empirical literature finds that elevated uncertainty leads to a decline in economic activity (see Bloom (2014) for a survey). However, understanding the mechanisms behind these empirical results is not trivial. In fact, several theoretical models predict the opposite, the primary reason being that uncertainty triggers a rise in the precautionary motive to save; in equilibrium, this can lead to an investment boom, and thereby expand, rather than contract, economic activity. To circumvent this rather puzzling prediction, the theoretical literature has pointed to negative demand effects of elevated uncertainty. In particular, nominal rigidities – typically modeled as “price stickiness” – may divert the increase in desired saving from an increase in investment into a decrease in goods demand, which thereby cause a contraction in economic activity (e.g., Basu and Bundick (2017)). Motivated in part by this theoretical mechanism, increases in uncertainty are sometimes seen as affecting the economy analogously to falls in aggregate demand (e.g., Leduc and Liu (2016)).

In a recent paper – developed before the pandemic – we offer new perspectives on the causal mechanisms underpinning the macroeconomic effects of heightened uncertainty (Freund and Rendahl (2020)). We explain the adverse effects of rising uncertainty on employment and activity using a search-and-matching (SaM) model of the labor market. A recession occurs even in the absence of nominal rigidities; but it is deeper in the presence of price stickiness. The analysis may help coherently reason about the implications of COVID-induced uncertainty for unemployment, inflation, and public policy.

Uncertainty shocks: why the labor market is important

The SaM framework – arguably the dominant theory of unemployment – describes the evolution of unemployment as resulting from the relative number of job losses and new `matches’ that are formed by vacancy-posting firms, on one side, and job-seeking unemployed workers, on the other. Workers are more likely to find a new job if there are many open vacancies relative to searching workers; the converse holds for firms’ probability of filling a vacancy. In marked contrast to theories in which labor demand and supply clear on a spot market, employment relationships are – realistically – modeled as long-lived and partially irreversible. A potential employer's vacancy-posting incentives are, therefore, a function of the entire sequence of expected future benefits from a hire, which in turn depend on the expected revenue product net of the wage. A vacancy is posted if and when the discounted sum of expected future profits outweighs the fixed cost of posting a vacancy. The long-horizon valuation of matches between employer and worker, and associated forward-looking vacancy-posting decisions, make this model particularly relevant when analyzing the effects of (increasing) uncertainty about the future.

We enrich the baseline model with a few more ingredients crucial to the question at hand. Most relevantly, households are risk averse; output is potentially demand-determined, as firms may not adjust prices sufficiently to maintain the original equilibrium outcome after a change in desired consumption by households; and the volatility of shocks to labor productivity is time-varying. We then derive the "pure uncertainty" impulse response function, which captures those effects of greater uncertainty that emerge because agents, perceiving the future to be less certain, change their behavior here and now. Changes in agents' expectations about the future thus trickle through to the present and affect current economic activity.1

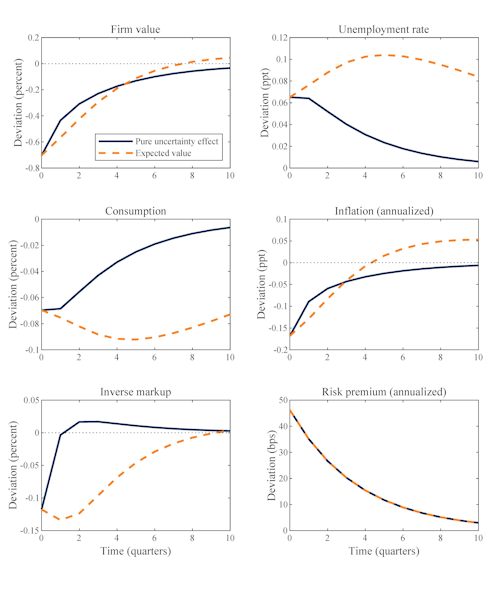

Figure 1 illustrates our main result, with the solid line capturing the pure uncertainty effects on the economy of a one standard-deviation increase in future volatility.2 The key point is that an increase in uncertainty reduces the value of a match between firm and worker (“equity price”); incentives for vacancy posting are consequently lower, so that it becomes harder for the unemployed to find a job; as unemployment rises, consumption falls. What is more, both inflation and the risk-free real interest rate (not shown) decline, and there is an increase in the risk premium on equity. Thus, as the economy recedes, prices for safe assets increase, while those on risky assets decline.

Figure 1. Uncertainty effects under sticky prices

Notes: The figure illustrates the impulse response of selected variables to a one standard-deviation shock to volatility under sticky prices; please refer to Freund and Rendahl (2020) for more details and other variables.

Insights about the economic transmission of uncertainty

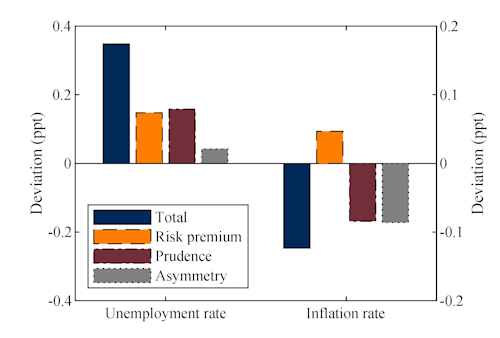

What mechanisms account for this outcome? Figure 2 decomposes the cumulative effect on two central macroeconomic aggregates, unemployment and inflation, into three driving forces. We describe them one by one.3

- Risk premium. Increased uncertainty about the future generates a stronger negative comovement between the marginal utility of consumption and the equity value; low payoffs are expected for precisely those periods where consumption will be low and, hence, less valuable (and vice versa). This negative comovement is captured by a rise in the required risk premium, causing a fall in the equity price and setting of the sequence of actions described before.4

- Prudence. As sketched above, a rise in uncertainty is associated with a precautionary motive to save that, under flexible prices, puts upward pressure on the price of all assets – not only risk-free bonds but also risky equity – which stimulates investment in job creation. In the presence of price adjustment costs, however, firms do not cut their prices sufficiently to prevent the concomitant fall in the willingness to purchase goods to reduce consumption, also in equilibrium. Instead, markups rise, and production is inefficiently low.5

- Asymmetry. SaM models distinctively exhibit asymmetries in the labor market such that, simply put, recessions are worse than booms are beneficial. Households anticipating the future to be more volatile, therefore, also expect average unemployment to be higher. As households aim to smooth consumption over time, this expectation reinforces a fall in intended consumption that, under sticky prices, deepens the recession.

Figure 2. Decomposition of cumulative effects

Notes: The figure decomposes the cumulative effect under sticky prices into the three driving transmission mechanisms. The computations are described in Freund and Rendahl (2020).

The dashed lines in Figure 1 help visualize some of the changes in beliefs about the future that underpin the pure uncertainty effects, and mechanisms laid out above. They describe the change in agents' expectations for the average value of the respective variable that is induced by the uncertainty shock (at the point in time the shock materializes). Unemployment is expected to remain high for a long time, reflecting the above-mentioned employment asymmetries. Such expectations provide the foundation for an outlook of persistently low aggregate demand and, therefore, low future asset prices. And as vacancy-posting decisions are forward-looking, such expectations feed into higher unemployment already in the present. In this way, according to the SaM paradigm the mere anticipation of future volatility worsens macroeconomic outcomes in the present.

Implications for the Phillips curve

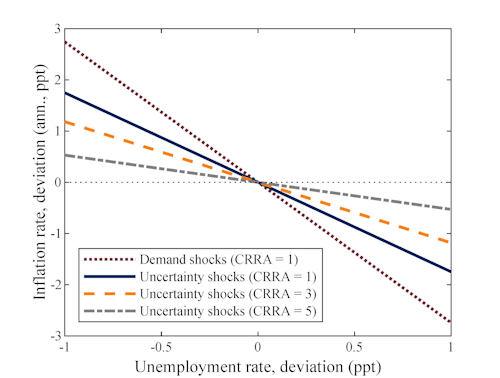

A cursory reading of Figure 1 suggests that uncertainty shocks affect economic activity no differently from regular demand shocks, such as contractionary monetary policy: inflation declines, consumption contracts, and the unemployment rate rises. There is a pronounced difference though. Following an uncertainty shock, the risk premium rises, causing a fall in the firm value that is orthogonal to demand effects, whereas no such effect is produced by a regular demand shock. Heuristically, this risk premium effect is akin to a negative supply shock, and thus associated with inflationary pressure that counteracts the otherwise disinflationary consequences of a fall in demand.

This result is not a mere curiosity. Figure 3 illustrates the implied observable relationship between deviations of inflation and unemployment from their means resulting from simulations of the economy under either demand or pure uncertainty shocks. The distinctive nature of transmission channels for uncertainty shocks is apparent: they render a relatively flatter “Phillips curve” relation between unemployment and inflation.6 If households are more risk averse than assumed in our conservative benchmark parameterization, this pattern becomes even more pronounced, as the risk premium channel takes on greater importance relative to demand forces.

Figure 3. Demand vs. uncertainty shocks: Phillips curve slopes

Notes: The figure shows linear regression lines fitted to simulated demeaned data of unemployment and inflation, under the baseline calibration with sticky prices. “CRRA” stands for “coefficient of relative risk aversion.” See Freund and Rendahl (2020) for methodological details.

Uncertainty, labor markets, and policy in times of COVID-19

Our research was conducted prior to the pandemic, and since our goal was to analyze highly nonlinear dynamics in the most transparent fashion, we consider a stripped-down theoretical framework that is rich enough to capture the key effects of interest but omits a manifold of quantitatively relevant features. We believe that the analysis may nonetheless help think through the `uncertainty component' of the COVID-19 economic shock in a coherent way. We conclude by highlighting three relevant angles.

Firstly, it is not only ambiguous whether the multifaceted first-moment component of the pandemic creates deficient or excess demand relative to supply (see Guerrieri et al. (2020), among others); because uncertainty carries both demand- and supply effects, the second-moment component likewise has mixed effects on inflation.

Secondly, if labor markets are frictional – as described in the SaM paradigm – rather than clearing on the spot, this suggests that worker-firm relationships are typically long-lived and subject to financial risk considerations (see Hall (2017)). COVID-induced uncertainty can, under these conditions, persistently depress hiring. To the extent that uncertainty remains protractedly high even when lockdown measures are lifted, this perspective makes a V-shaped recovery accordingly seem less likely.

Finally, to the extent that greater uncertainty over future economic conditions has adverse effects on labor markets in the present, the management of expectations (e.g., through forward guidance) assumes an even more important role than is already commonly recognized. In particular, by limiting perceived uncertainty over future consumption, employment, and asset returns, public policy can limit recessionary impulses due to falling demand and rising risk premia. In view of the interlocked nature of public health and the economy, stabilizing expectations in such a way requires an integrated approach and consistent communication from different arms of the government.

Read the full Working Paper: Unexpected Effects: Uncertainty, Unemployment, and Inflation

References

Baker, S R, Bloom, N, Davis, S J, Terry, S J (2020), COVID-Induced Economic Uncertainty, NBER Working Paper 26983.

Basu, S and Bundick, B (2017), Uncertainty Shocks in a Model of Effective Demand, Econometrica, 85(3), 937–958.

Bloom, N (2014). Fluctuations in Uncertainty, Journal of Economic Perspectives, 28(2), 153–176.

Den Haan, W J, Freund, L B, and Rendahl, P (2020), Volatile Hiring: Uncertainty in Search and Matching Models, CEPR Discussion Paper DP14630.

Freund, L B and Rendahl, P (2020), Unexpected Effects: Uncertainty, Unemployment, and Inflation, Cambridge-INET Working Paper WP2020.

Guerrieri, V, Lorenzoni, G, Straub, S, and Werning, I (2020), Macroeconomic Implications of COVID-19: Can Negative Supply Shocks Cause Demand Shortages?, NBER Working Paper 26918.

Hall, R E (2017), High Discounts and High Unemployment, American Economic Review, 107(2), 305–330.

Leduc, S and Liu, Z (2016), Uncertainty Shocks are Aggregate Demand Shocks, Journal of Monetary Economics, 82, 20–35.

Leduc, S and Liu, Z (2020), The Uncertainty Channel of the Coronavirus, FRBSF Economic Letter, 30 March 2020.

Schaal, E (2017), Uncertainty and Unemployment, Econometrica, 85(6), 1675–1721.

1 Further information about the theoretical model and our numerical implementation, i.e., parameterization and nonlinear solution methods, can be found in Freund and Rendahl (2020).

2 To preempt any misunderstanding, Figure 1 does not illustrate our estimates of the effects of Covid-19 induced uncertainty. The actual increase in measured uncertainty is more dramatic than the one standard-deviation shock we are feeding in here and, more fundamentally, the model was simply not designed to provide a comprehensive, quantitative assessment of the effect of uncertainty shocks. Physical capital (investment), for instance, is not included in the model. What is more, the solid line in Figure 1 zooms in on the effects of perceived greater future volatility, whereas the current situation arguably involves more extreme realized volatility also.

3 Some readers may be surprised to see no mention of option value considerations or "wait-and-see" effects. We consider such a mechanism intuitively plausible and refer to Schaal (2017) for a model that incorporates it. But it plays no role in the canonical SaM framework considered here (Den Haan et al. (2020)).

4 In the paper we highlight that the risk premium mechanism operates also in the absence of sticky prices. Indeed, it explains why our model gives rise to contractionary uncertainty effects even under flexible prices, when the prudence and asymmetry channels are expansionary.

5 This description presumes monetary authorities set interest rates according to a conventional Taylor rule. See Section 4.2 of Freund and Rendahl (2020) for details.

6 With the "Phillips curve" we refer to the observed relationship between inflation and unemployment, not to the parameters of a structural equation.

About the authors

Lukas B. Freund is a PhD candidate in Economics and Gates scholar at the Faculty of Economics, University of Cambridge. His research interests are in macroeconomics, with a particular focus on labor markets and productivity.

Dr Pontus Rendahl is a University Reader at the Faculty of Economics, University of Cambridge. His research interests are in Macroeconomic Theory with Applications. Recursive and Numerical Methods.